Food and beverage manufacturers are finding new sources for manufacturing digestion resistant maltodextrin, such as cassava, bananas, rice, and many more. In addition to this, they are making advancements in their manufacturing processes. This increase in demand and technology progress witnessed in the food & beverages industry will boost the growth of the digestion resistant maltodextrin market in the coming years.

“Large number of consumers are gradually looking for healthier, authentic, and plant-based ingredients in their food. Thus, many food manufacturers are shifting towards natural ingredients to meet this consumer demand, and sustain their position in the digestion resistant market,” says an FMI analyst.

Request a report sample to gain comprehensive market insights @

https://www.futuremarketinsights.com/reports/sample/rep-gb-6225

Key Takeaways from Digestion Resistant Maltodextrin Market Study

- Increasing number of consumers are seeking products that are naturally derived from different plant-based sources. Digestion resistant maltodextrin is a kind of natural dietary fiber that suits the rapidly rising consumer interest in healthy lifestyle and healthy food. Thus, the demand for digestion resistant maltodextrin is surging.

- The global digestion resistant maltodextrin market has been segmented on the basis of form, where the spray-dried powder segment holds a major share. However, in the coming years, the agglomerated form segment is expected to show positive growth due to its increasing use in different instant food and drink products.

- In terms of application, the food segment contributes more than half of the total digestion resistant maltodextrin market share. Digestion resistant maltodextrin is included in breakfast cereals, dairy products, instant pudding, margarines & butters, salad dressing, sauces, snacks food, and others foods. Of these, its use is predominant in breakfast cereals. Besides, it is also witnessing high demand from the beverages segment.

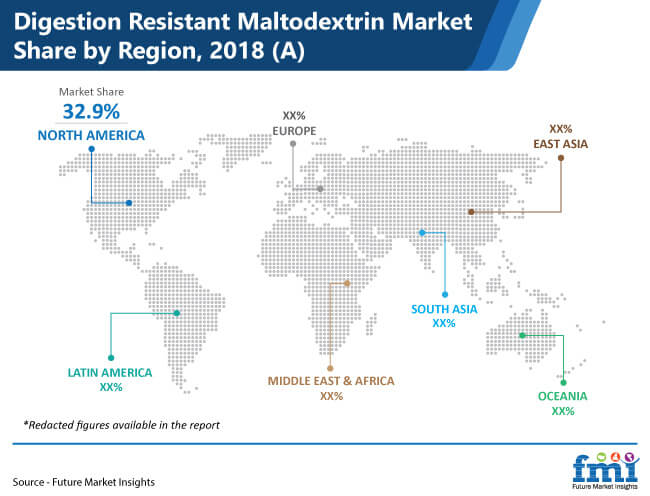

- Europe and North America are anticipated to dominate the global digestion resistant maltodextrin market in terms of value. The demand for digestion resistant maltodextrin is considerably high in East Asia, which is expected to experience a higher growth rate over the forecast period, due to rising obesity among people and increasing incidence of lifestyle diseases. The Latin America market, dominated by Mexico, is also exhibiting high demand for digestion resistant maltodextrin.

For Information On The Research Approach Used In The Report, Ask Analyst @ https://www.futuremarketinsights.com/ask-question/rep-gb-6225

Resistant Maltodextrin Manufacturers to Invest in R&D for Developing Unique End-user-oriented Products

- Leading companies operating in the digestion resistant maltodextrin market are increasingly investing in brand promotion activities to scale up their sales capacity and provide consumers with unique end products with high quality. Digestion resistant maltodextrin manufacturers are expanding their supply chain to meet the growing demand from food, drink, and nutraceutical product manufactures

- On June 21st, 2018 Roquette, one of the leading food companies, got its digestion resistant maltodextrin listed under the brand name NUTRIOSE®, under the list of FDA dietary fibers.

- On May 1st, 2006, Archer Daniels Midland Company declared the foundation of a joint venture between ADM, Matsutani Chemical Industry Co., Ltd., and Matsutani America, Inc., to support the worldwide sales and marketing of Fibersol® as a brand of digestion resistant maltodextrin.

Find More Valuable Insights into Digestion Resistant Maltodextrin Market

Future Market Insights, in its new offering, provides an unbiased analysis of the global digestion resistant maltodextrin market, presenting historical demand data (2016-2018) and forecast statistics for the period of 2019-2029. The study divulges compelling insights into the digestion resistant maltodextrin market based on source (corn-based, wheat-based, potato-based, cassava-based, and others), application (food- in breakfast cereals, dairy products, instant pudding, margarines & butters, salad dressing, sauces, snacks food, and others; beverages- alcoholic beverages and non-alcoholic beverages; and nutraceuticals), and form (spray-dried powder, and instantized/ agglomerated), across seven major regions.